WHO ARE WE?

SLG Wealth Management is an independent asset manager and multi-familly office company regulated by OAR-G under the control of FINMA (Authorization n ° 1185).

Our team has more than 50 years of experience in wealth management and financial services.

Founded by experienced former private bankers who have decided to provide to their client’s high-level services and independent and customized financial solutions.

We are at your side to protect all aspects of your wealth. SLG Wealth Management has no conflict of interest with its business partners or customers.

Our investor choices or our advice are guided exclusively by the interests of our clients.

We manage the assets of our customers in a third part agreement that mean the assets of our clients are in a custodian bank that we choose with the client.

With our experience, we’re established quality professional contacts with various experts in the different areas of the wealth management (investment funds, law firms, real estate agencies, notary public…) at the international level.

Our objective is to advice and serve clients the long path in order to provide on accompaniment for a transition transgenerational.

We are already registered with a number of leading depository banks in Switzerland and can accompany our customers in all aspects their wealth in Switzerland and internationally.

INTERNATIONALLY FOCUSED WITH STRONG BASES IN GENEVA

Diversity

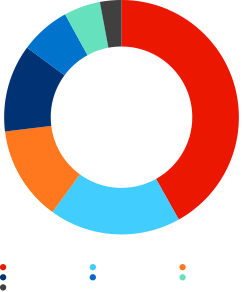

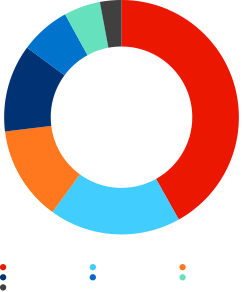

Breakdown of cross-border private assets under management by region, in percent, based on customer domicile.

Security

Almost half of the assets under management come from abroad.

Switzerland : leader

The swiss banks manage around 27% of global assets managed cross-border.

Extensive experience in international wealth management

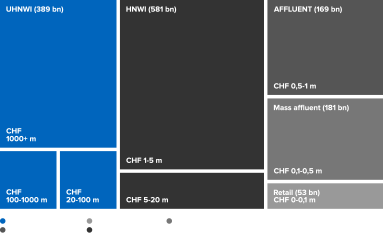

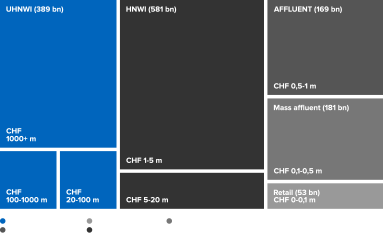

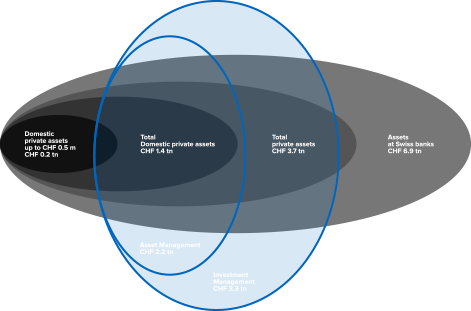

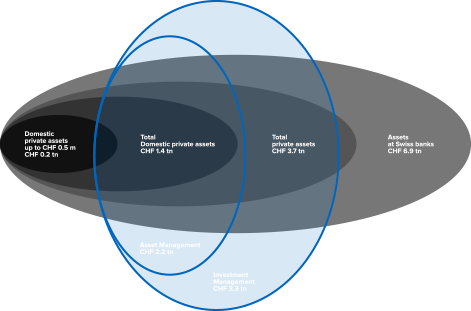

Assets under Management for domestic clients 2018. By segment, investible assets (cash, deposits, securities).

Protect your privacy

The internationally managed private assets have increased by CHF 300 billion from 2013 to 2018.

Political and legal stability

The swiss financial center : closely interconnected.

CORE VALUES

Trust

With a family focus, we advise our clients over time, their assets not being managed operation by operation but from generation to generation. Therefore, we are not guided by short-term considerations, our goal being to support our customers in a trans-generational way.

Independence

Our philosophy is based on the total independence of our work. Our income comes 100% from fees agreed upon with our clients. We do not have any retrocession from banks, advisors, suppliers or others that are not disclose to the direct.

Transparency

Each wealth advice we propose is guided exclusively in the interest of the client.

Know How

Our multidisciplinary team has acquired more than 50 years at the service of the wealth of our clients on an international scale.

Efficiency

Like a bandmaster, we help our client maximize synergies between the various advisors and providers working for their assets.

Confidentiality

Tax transparency does not mean the end of banking secrecy, which is always protected in several countries in order to preserve the integrity of the family and its wealth.

Donations strategies

Foundation to grant scholarships and subsidies

Gifts during lifetime

Life insurance

Inheritance planning

Business succession planning

Continuity of the Company

Premarital agreements and wills

Tailored-made investment solution

Independent

No conflicts of interest

Risk capital

Investment strategy and asset allocation

Consolidated reports

Investment advice

Family assemblies

Family protocol

Family council

Building of societies

Family Shareholdings

Trust

Cancellations Services

Real estate managements

Planes and yachts

Relocation abroad

Tax returns filings

Real estate management

Planning of double taxation treaties

News and Tailored-made experiencies

BALANCE SHEET AND INCOME STATEMENT

Usefulness of balance sheets and income statements The balance sheet will describe the value of the business at any given time. It thus gives indications to […]

This is not in any case a call for the investment

SOFTWARE DEPOSIT AND VERSION MANAGEMENT

A version control system is responsible for managing changes to data in a repository. This can include code, websites, documents, or any other collection of information. […]

This is not in any case a call for the investment

THE HEALTH INSURANCE SYSTEM IN SWITZERLAND IN BRIEF

Health insurance: the Swiss exception Health insurance, which is compulsory in Switzerland, is governed by the law on the LAMal (law on health insurance). Anyone who […]

This is not in any case a call for the investment

YOUR CUSTOMIZED INVESTMENTS 2: ACTIONS AND BONDS

What are stocks and bonds used for? Issuing stocks and bonds allows companies or states (through bonds) to acquire new capital. This can be useful for […]

This is not in any case a call for the investment