The swiss banks manage around 27% of global assets managed cross-border. Overall, the volume of assets under management in Switzerland grew from CHF 1,970 bn in 2013 to CHF 2,270 bn in 2018. The volume of assets from customers from all regions of the world increased. The largest growth of CHF 110 bn was seen in the category “Other”, which encompasses Eastern Europe, CIS countries and Africa.

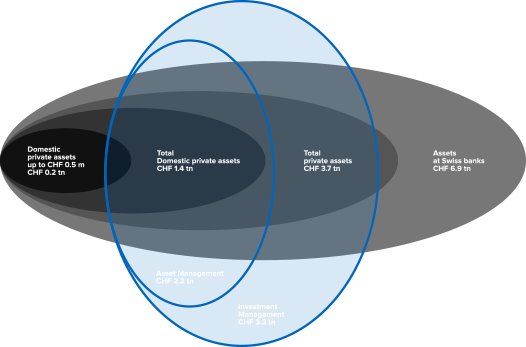

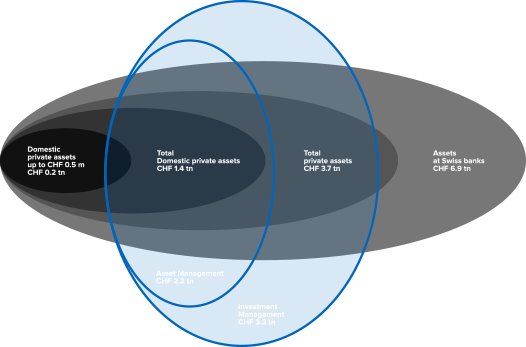

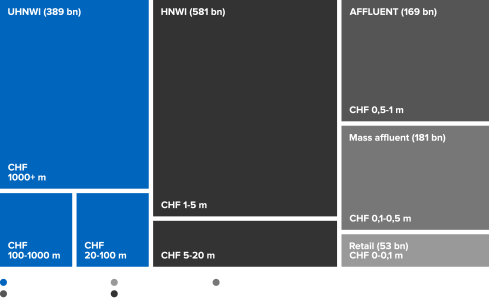

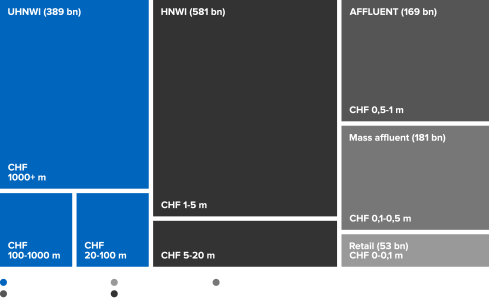

Banks in Switzerland had a total of CHF 6.9 tn of assets under management at the end of 2018. Domestic private customers with assets of up to CHF 0.5 m accounted for CHF 0.2 tn of this sum. A further CHF 1.1 tn of this figure comprises domestic customers with larger volumes of assets. In total, CHF 2.3 tn is managed in the cross-border wealth management business

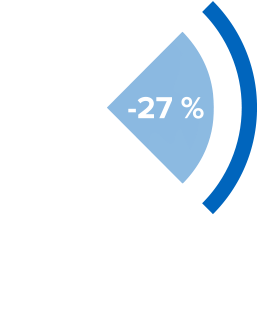

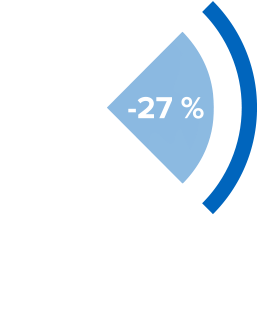

The Swiss financial centre is one of the most competitive in the world and remains the global leader in the cross-border wealth management business.

Cross-border private assets under management increased by CHF 300 billion between 2013 and 2018

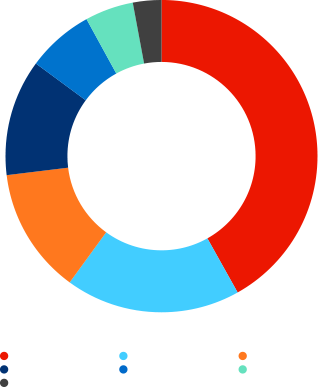

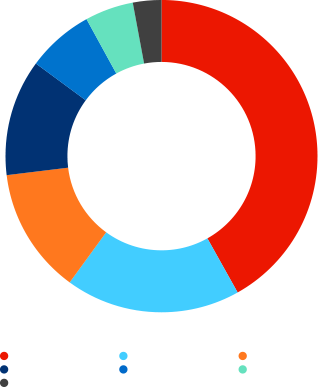

Western Europe, which accounts for 42% of assets under management, is by far the most important market for Swiss Wealth Management, followed by the Middle East, Latin America and Asia.

Some of the assets in the country are managed via investment solutions created in Switzerland.